Our Beliefs

Empowering Confident and Successful Retirements

At Hague Wealth Management, we hold strong beliefs that challenge traditional Wall Street advice. We have witnessed firsthand the limitations of relying solely on stock market performance, as it often resembles nothing more than "dart throwing" with stocks and mutual funds. This sentiment is not just our opinion; even renowned investors like Warren Buffett and Charlie Munger have echoed similar concerns..."...roughly 91% of all Money Managers underperform their benchmark."

Our beliefs are rooted in the pursuit of protected growth and lifetime income that can never be outlived. We envision portfolios that consistently move forward, never backward, and ONLY go up, and NEVER down.

Our ultimate goal is to offer our clients the opportunity to enjoy the life of a SWAN (Sleep Well At Night).

Since 1999, we have witnessed the tangible results that affirm our motto: "Build, Preserve, and Protect Your Assets." Our approach focuses on building portfolio value over time, guaranteeing protected growth. We prioritize preserving our clients' overall values and, more importantly, safeguarding their purchasing power throughout retirement. We recognize that living costs only move in one direction—up—and so should our income.

Protecting our clients' life savings from loss is paramount. We achieve this by enabling them to enjoy market-based returns while avoiding any and all market-based losses. This principle has been ingrained in our practices since day one and will continue to guide us in the future.

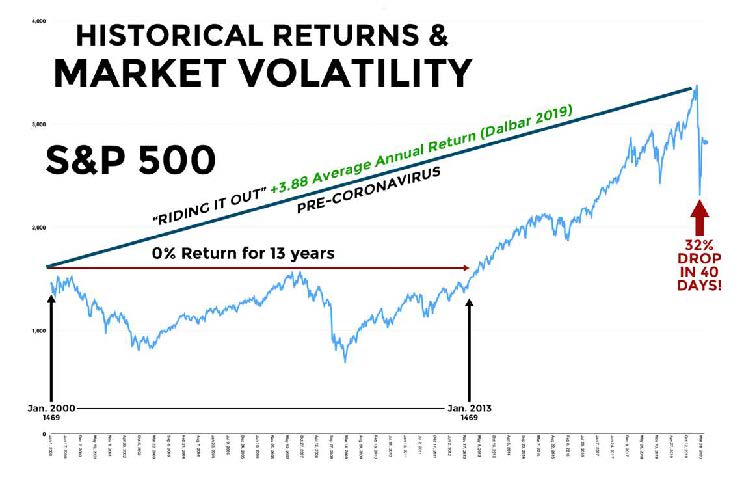

In 1999, we embarked on a pivotal transition away from strictly stock market-based strategies. We recognized that tying 100% of our clients' success to a single variable—the stock and financial markets—did not provide the peace of mind necessary for a confident and successful retirement. Although the markets may offer fleeting moments of success, the long-term returns of the stock market, as exemplified by the S&P 500, have been lackluster at best according to Barron's Magazine and Dalbar. Dalbar’s Industry-renowned Quantitative Analysis of Investor Behavior ("QAIB”) shows the typical investor in equity mutual funds has earned only a 3.88% annual return over the last 20 years before inflation (2000-2020).

(SEE THE LOST DECADE 2000-2013)

Through our journey, we have discovered a clear and straightforward approach that has consistently yielded true and verifiable long-term and short-term success. We firmly believe that our clients' success lies not only in how much we make in up markets but, more importantly, in how much we retain and do not give back in down markets.

For over two decades (and three decades in the industry), our clients have experienced documented success through

Strength, Power, and Predictability of Protected Growth and Lifetime Income.

We are committed to empowering Confident and Successful Retirements through these proven strategies.